In plain English creditors cannot take these monies via bank garnishment. Parties cannot take part or all of your settlement as payment for your debts.

Is Your Personal Injury Settlement Taxable Ron Bell Injury Lawyers

The IRS can also seize more money at a time than a creditor is usually allowed to take.

. Although not commonly included in personal injury settlement punitive damages are taxable. In many cases the insurance company will submit a. 85-97 - The entire amount received by an individual in settlement of a suit for personal injuries sustained in an accident including the portion of the amount allocable to the claim for.

If the IRS already has a lien on your personal property it could potentially take your. If you have back taxes yesthe IRS MIGHT take a portion of your personal injury settlement. Was hit by a SUV last year pedestrian hit and am in the process of a settlement.

Generally speaking if your settlement is due to physical injury or illness and was the result of a tort ie wrongful act injury or action then the settlement may not be taxable. We still have some. Contact the Law Office of Cohen Jaffe.

Can the IRS take my personal injury settlement for back taxes. Alternatively the IRS may not have filed a lien but could still claim taxes against a portion of your compensation. The answer is no.

The decedent owned a building that was damaged in a fire. Whats In This Guide. If I get married to my partner that owes.

The IRS can only pursue those portions of the settlement not intended as. If you are dealing with creditors who are attempting to collect on debts owed you can quickly find yourself facing a complex situation. IRS Tax Rules on Injury Settlements The Internal Revenue Service IRS will have access to your settlement information.

Additionally if you are paid any interest on any settlements that is taxable also. Neither the federal government the IRS not the state government can tax your settlement amount or the proceeds in the majority of personal injury cases. Private message Posted on Jan 31 2017 As the previous attorney commented you can certainly receive smaller incremental payments so the entire settlement doesnt disappear.

Are personal injury settlements taxable income. You should retain an experienced personal injury attorney and they can help you receive compensation that leaves you in the same financial position as you were in before the accident. This all will depend on the type of case and the type of compensation for the injuries suffered.

Your personal injury settlement is fair game for them. A personal injury settlement can be taxable nontaxable or just partially taxable. So while the Internal Revenue Service might take a portion of your personal injury settlement this only happens in certain situations.

But its not all bad news. Fortunately for Alberta car accident settlements there is a straightforward answer to this commonly asked question. However you might have to take certain steps to ensure your settlements protection from.

Fortunately monies from injury settlements or workers compensation settlements are considered exempt. Personal physical injuries or physical sickness If you receive a settlement for personal physical injuries or physical sickness and did not take an. This case however points out that an IRS tax lien can attach to other property that the taxpayer owns or receives.

Can The Irs Take My Personal Injury Settlement Uplift Legal Funding

Is My Personal Injury Settlement Subject To Taxation Schauermann Thayer Washington Oregon Injury Attorneys

.jpeg)

You Might Owe Federal Taxes On Your Personal Injury Settlement Kearney Freeman Fogarty Joshi Pllc

Tax Liabilities Of A Personal Injury Settlement Adam S Kutner Injury Attorneys

Can My Personal Injury Settlement Be Taxed Gordon Partners

How Personal Injury Settlements Are Taxed In 2020

Can The Irs Take My Personal Injury Settlement In Philadelphia

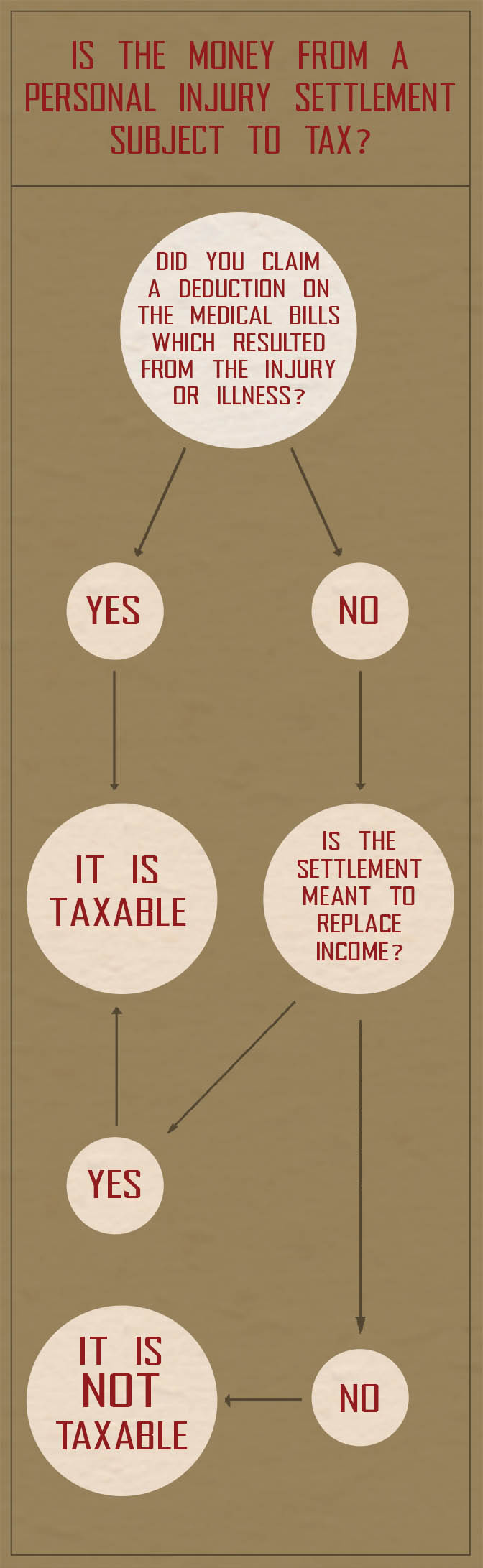

Is The Money From A Personal Injury Settlement Subject To Tax The Reeves Law Group

0 comments

Post a Comment